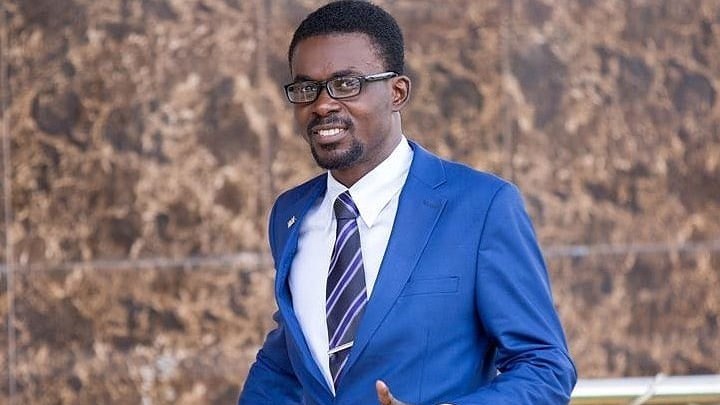

The State on Tuesday filed new charges against the Chief Executive Officer of Menzgold, Nana Appiah Mensah also known as NAM 1 at the Accra Circuit Court.

Assistant Superintendent of Police (ASP) Sylvester Asare told the Court that the State had filed a new charge sheet against the accused but no plea was taken during the sitting.

The prosecutor pleaded with the court that not to take his plea as there will be further instructions going forward.

The Court presided over by Ms Ellen Asamoah granted the request of the prosecution.

NAM 1 is facing 63 counts of money laundering, stealing, taking deposits without authority with other family members now at large.

His lawyers were not opposed to the new charge sheet but pleaded with the Court to expedite the process for their client.

There was a heavy security presences when NAM 1 appeared in Court.

The Circuit Court on July 26, 2019 granted NAM 1 bail in the sum of GH¢ 1 billion cedis with five sureties, three to be justified.

He had pleaded not guilty to all initial 13 charges levelled against him by the State.

He is also to report to the police every Wednesday at 1000 hours.

He was initially charged with abetment of crime, defrauding by false pretences, carrying on a deposit-taking business without licence, sale of minerals without licence, unlawful deposit taking, and money laundering.

It is alleged that the accused had taken various sums of money, totaling GH¢1.6 billion from customers.

The court adjourned the trial to Monday, July 20.

It may be recalled that, in July 2019, a Dubai High Court hearing a case involving Menzgold CEO, Nana Appiah Mensah and his Arabian debtors, Royal Horison, has upheld its earlier ruling ordering the United Arab Emirates-based company to pay up $39 million owed the Ghanaian, after the Ghanaian businessman was arrested in a botched business transaction.

Menzgold is currently holding up the investments of thousands of customers in Ghana, who have since September, last year, been unable to access both their interests and principal.

The company was paying between seven and 10 per cent in monthly interest rates on investments, but both the Bank of Ghana and the Security and the Exchanges Commission (SEC) warned Ghanaians over the risk of their investments, likening it to a Ponzi scheme.

The SEC, subsequently, directed Menzgold to stop receiving deposits, amidst protests from both the company and its customers.

By:Isaac Clottey