The Bank of Ghana (BoG) has revised its timeline for the attainment of single-digit inflation to the second quarter of 2026 due to macroeconomic headwinds.

This is an extension of the previously anticipated first quarter timeline.

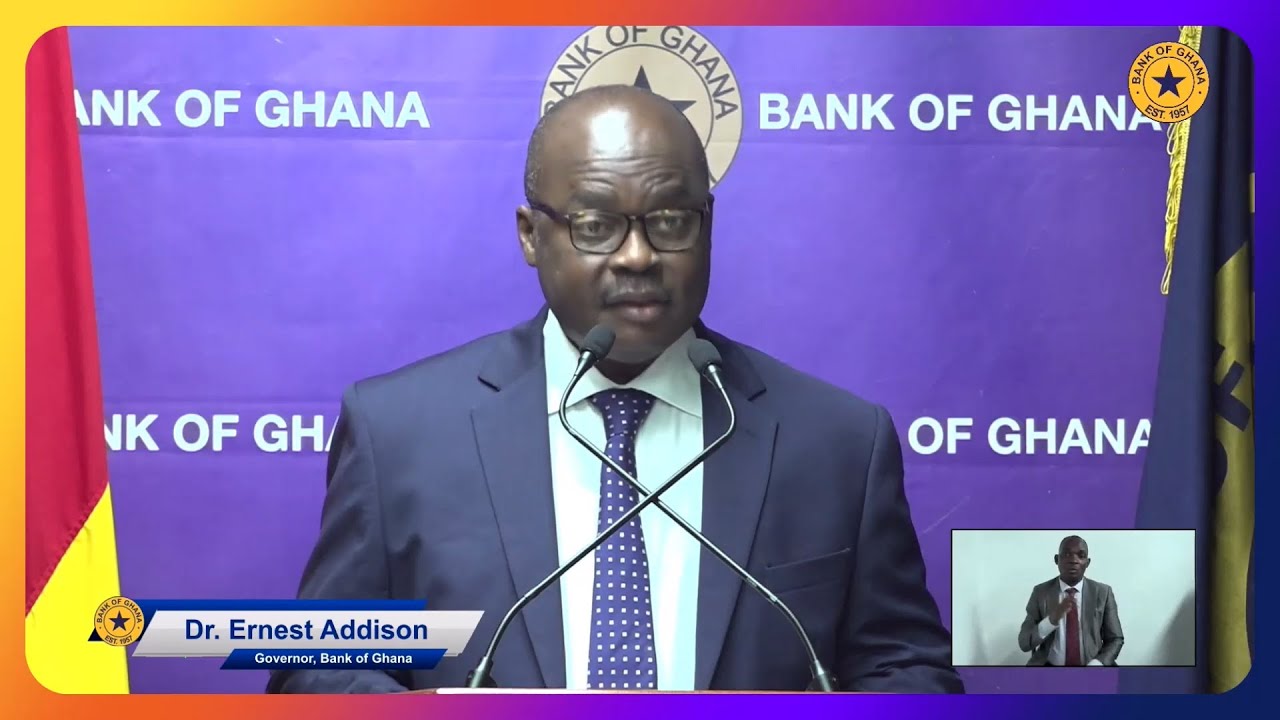

The Governor of the Bank of Ghana, Dr. Ernest Addison, made this known during the 122nd Monetary Policy Committee press briefing in Accra.

The central bank’s medium-term inflation objective remains anchored within the 8±2 percent band, consistent with its price stability mandate.

But Governor Dr. Addison attributed the timeline extension to persistent macroeconomic vulnerabilities and structural rigidities.

He underscored that the revised forecast hinges on continued fiscal consolidation, tighter monetary policy, and adherence to benchmarks under Ghana’s Extended Credit Facility (ECF) programme with the International Monetary Fund (IMF).

He admitted that the path to achieving price stability will require sustained fiscal discipline, improved external sector performance, and structural reforms to address supply-side constraints and enhance productivity.

The Governor, Dr. Ernest Addison, added that the Central Bank will continue with its cautious stance in the face of underlying inflationary pressures and global economic uncertainties.

Persistent inflationary pressures compelled the Central Bank to keep its monetary policy rate unchanged at 27%.

The decision to hold the rate steady is to counter elevated inflation risks and support the country’s ongoing economic recovery efforts.

It also comes after Ghana failed to meet its 2024 end-year inflation target of 15% as the rate inched up to 23.8% in December last year.