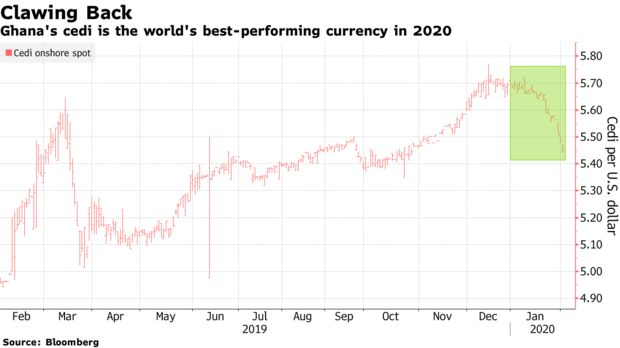

Ghana’s cedi, the world’s best-performing currency against the dollar this year, extended its advance on Monday as investors await a Eurobond sale that would bolster the government’s coffers.

The currency of the world’s second-biggest cocoa producer has strengthened 3.9% in 2020, the most among more than 140 currencies tracked by Bloomberg, a turnaround from last year, when it weakened 13%.

The coronavirus outbreak and the recent lunar new year holiday in China has cut back travel and trade, reducing demand for foreign currency from Ghanaian importers, according to Nana Yaa Faakye, Head of Treasury at Republic Bank Ghana Ltd. The West African country is concluding a series of meetings with international bond investors Monday for a sale of as much as $3 billion in Eurobonds.

“With the impending Eurobond issuance, which is likely to increase foreign reserves, some buyers are betting that the cedi will strengthen further,” Faakye said.

The central bank’s tight monetary stance is also supporting the currency, said Steve Opata, head of financial markets at the Bank of Ghana. Market reforms including the introduction of forward-rate foreign exchange auctions since October, with a target of $715 million this year, are another factor in favor of cedi gains, he said.

“The country’s high nominal interest rates matter to investors as it will give them some immunity when the currency depreciates,” Stephen Bailey-Smith, a investment strategist at Kolding, Denmark-based Global Evolution, said by phone. “We have obviously seen some guys come back into the market.”

Source:bloomberg.com