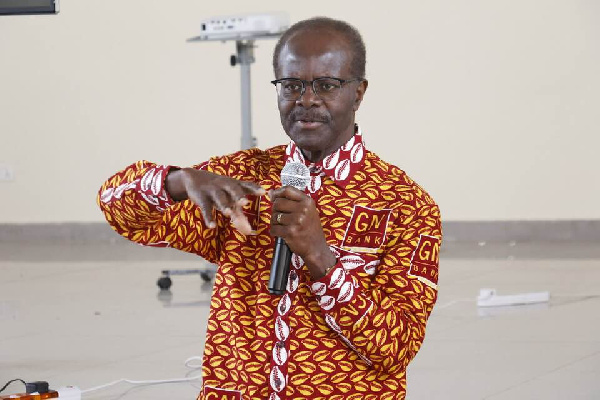

The Human Rights Division, Accra High Court, has dismissed an application filed by Dr. Papa Kwesi Nduom, GN Savings and Loans Company and others for the violation of fundamental human rights in its entirety.

Dr. Ndoum filed an application against the Bank of Ghana (BoG), the Attorney General and the Receiver of the savings and Loans companies, praying the Court to revert the decision by BoG to revoke the license of GN Savings and Loans, saying the action was a violation of his fundamental human rights.

Meanwhile, applicants have served notice of an appeal.

The Court, presided over by Justice Gifty Addo Adjei, delivering judgment on the case, said the Central Bank was right when it revoked the license of the third respondent because it had become apparent that it was unable to meet its debt obligations due to poor governance structures.

Initially, lawyers for the BoG raised a legal objection to the application on the basis that the jurisdiction of the High Court had been wrongly invoked because matters of banking revocation were expected to go for arbitration at the Arbitration Centre.

But Justice Srem Sai vehemently opposed this argument.

The Court said the applicant had not been able to satisfy the court that, at the time of the revocation of its license, it was solvent and able to meet its debt obligations.

Justice Addo Adjei said the claim by the applicants of unreasonableness coupled with malice and violation of existing laws in the process of the revocation was unfounded.

On the violation of the rights of the Administrative justice, the court was of the view that the Central Bank intervened in the applicants’ operations by way of revocation of license according to the provisions of Article 130 of the 1992 Constitution, noting that “No illegality was occasioned by the conduct of the Central Bank in revoking the license in the face of insolvency.

She said BoG had not breached the fundamental principles imbibed in its status. The court said the Central Bank took the most reasonable and fair decision in the face of the liquidity challenges under its mandate.

On the issue of discrimination, the court concluded that the applicants were not discriminated against since other entities suffered a similar fate as the applicant’s, adding that their complaints are unfounded and without merit.

The court awarded a cost of GH₵50,000 in favor of all the respondents.